Seedscore: What your score says about you ( & how to improve it)

What Your Score Says About You (and How to Improve It)

Have you ever wondered how lenders decide whether to approve your loan request or leave you with a crushing rejection?? The secret sauce behind that life-changing “yes” or “no” often boils down to one critical number: your Seedscore. It’s the invisible gatekeeper that can either open doors to financial freedom or leave you stuck in limbo.

Lenders don’t just hand out money willy-nilly (we wish, right?). Think about it: would you borrow cash to that friend who always “forgets” to pay you back or suddenly goes MIA when it’s repayment time? Probably not. Well, lenders feel the same way! They carefully assess their customers to determine the likelihood of getting their money back.

Now, I’m sure you’re wondering, “What on earth is Seedscore, and why should I care?” Don’t worry, we’re about to get to the good stuff—your aha! moment is coming right up.

Seedscore is SeedFi’s way to help you crack the code of accessing credit and take charge of your financial freedom. It’s like having a financial GPS that shows you exactly where you stand in the lending world and maps out the opportunities waiting for you. Whether it’s unlocking better loan rates, or finally getting that loan approved, Seedscore is the key to turning “someday” into “today.” Ready to take control? Check your Seedscore now.

So, what’s your score saying?

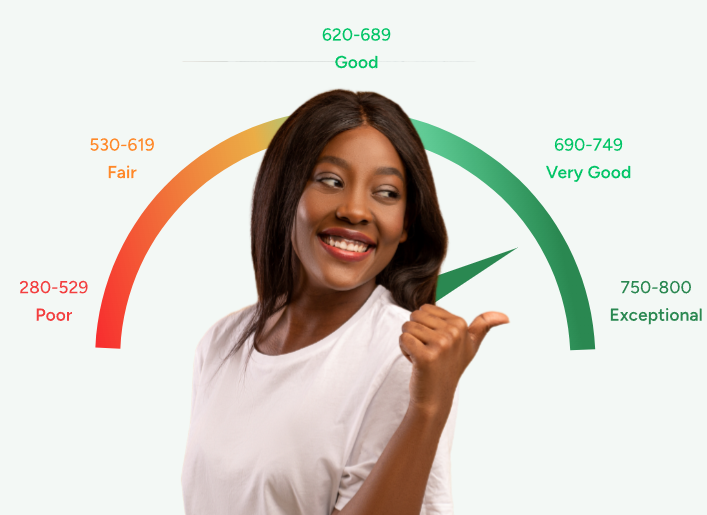

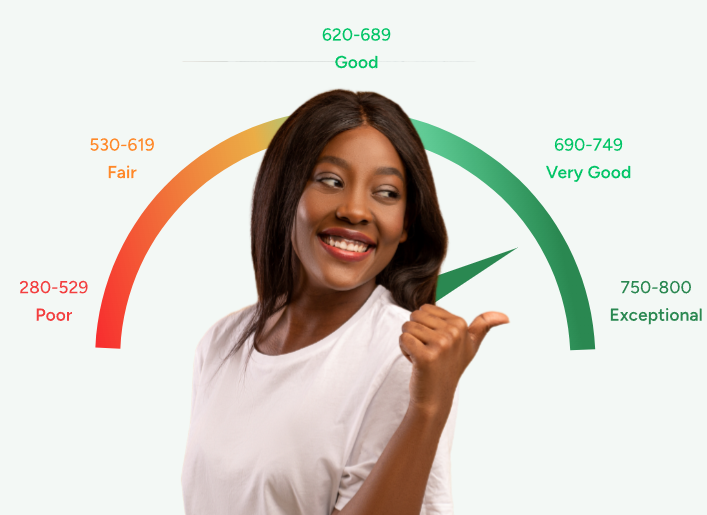

SCORING GUIDE

Poor: 280 – 529

Fair: 530 – 619

Good: 620 – 689

Very Good: 690 – 749

Exceptional: 750 – 800

- Green Zone? You’re winning! This means you’re a top performer, and lenders see you as a responsible borrower. Keep it up!

- Amber zone? This means you have a fair score, but there’s room for improvement. Making timely repayments and managing your credit wisely can push you into the Green Zone.

- Red Zone? This means your credit health needs some work, but don’t panic—it’s not the end of the road.

If your score isn’t where you want it to be, there’s still hope! There are simple ways to improve your creditworthiness, and we’ve already put together a guide to help you out. Check out our last blogpost for actionable steps to boost your score and unlock better credit opportunities.

Now, let’s talk, are you happy with your Seedscore? Do you need some one-on-one financial advice to help get things back on track? We’re here to help. Fill this form and we’ll reach out to you.

Let’s work together to build a stronger financial future for you!